The Self-Fulfilling Prophecy: Psychology, Markets, and the Mechanics of Belief

A self-fulfilling prophecy begins as a belief — a mere expectation about what will happen — and ends as the very cause that makes it so. It is the loop between perception and reality, where anticipation births the outcome that later seems inevitable. Once articulated and shared, a forecast becomes choreography.

Robert K. Merton named the mechanism: a “false definition” can evoke behavior that makes the falsehood true. In finance, we see it whenever a rumor of fragility prompts deposit withdrawals that create the bank run, or when a consensus “beats” threshold turns earnings season into a ritualized surprise. Perception moves people; people move markets; markets move the perception.

The logic is not mystical. It is mechanical. Expectations translate into orders; orders interact with the order book; the order book prints trades; prints set price; and price is the loudest story in the room. By the time the tape has spoken, the prophecy feels confirmed — even though it was our collective reaction that authored the confirmation.

This is why price often runs ahead of fundamentals and why corrections can overshoot both value and sense. We are not neutral observers. We are participants whose beliefs become inputs, whose caution or euphoria becomes liquidity — or the lack of it.

Markets as Mirrors of Expectation

Every chart is a portrait of shared anticipation. Not a transcript of objective truth, but a record of agreements and fears — a mirror that answers, “What did we believe together, long enough and loudly enough, to act upon?” The market is a theatre; price is applause; volume is chorus.

Keynes’s “beauty contest” lives on in modern form: we try to pick what the crowd will pick, and in doing so, we create the crowd. Anchors such as round numbers, 52-week highs, and options strikes become Schelling points — coordinates we converge upon not because physics dictates them, but because we expect others to converge there.

This expectation channels order flow. Buy stops cluster above obvious resistance; sell stops pool under obvious support. When price approaches those zones, liquidity thins, spreads widen, and a small nudge can cascade into a breakout or breakdown that looks like destiny. It wasn’t destiny. It was structure welded to belief.

Modern microstructure intensifies this mirror. Auction opens, closing crosses, and systematic rebalancing windows compress participation into predictable bursts. The more calendarized our behavior, the easier it is for a widely held expectation to become the event.

Reflexivity and the Feedback of Belief

George Soros reframed the loop as reflexivity: market participants’ biased perceptions do not merely reflect reality; they actively shape it. Expectations change valuations; valuations change access to capital; access to capital changes corporate outcomes — which then “justify” the original expectations.

Consider housing booms. Rising prices boost collateral values, enabling more credit, fueling more bids, lifting prices again. Positive feedback dominates until constraints bite; then the feedback flips negative, and the same mechanics accelerate the fall. Reflexive systems trend, then snap. They do not glide to equilibrium; they lurch between beliefs.

In public markets, index inclusion, passive flows, and collateralization amplify reflexivity. A name that rallies on narrative attracts flows from momentum strategies, earns upgrades that lower its cost of capital, funds acquisitions that grow revenue, and earns more narrative. The story lifts the multiple; the multiple finances the story.

Reflexivity is not a flaw to be removed; it is a property to be understood. It tells us why “fair value” is a moving target and why valuation alone can be a weak timing tool. It also explains why transparency (guidance, dot plots, roadmaps) can stabilize expectations — or, when poorly set, destabilize them.

Indicators as Instruments of Collective Expectation

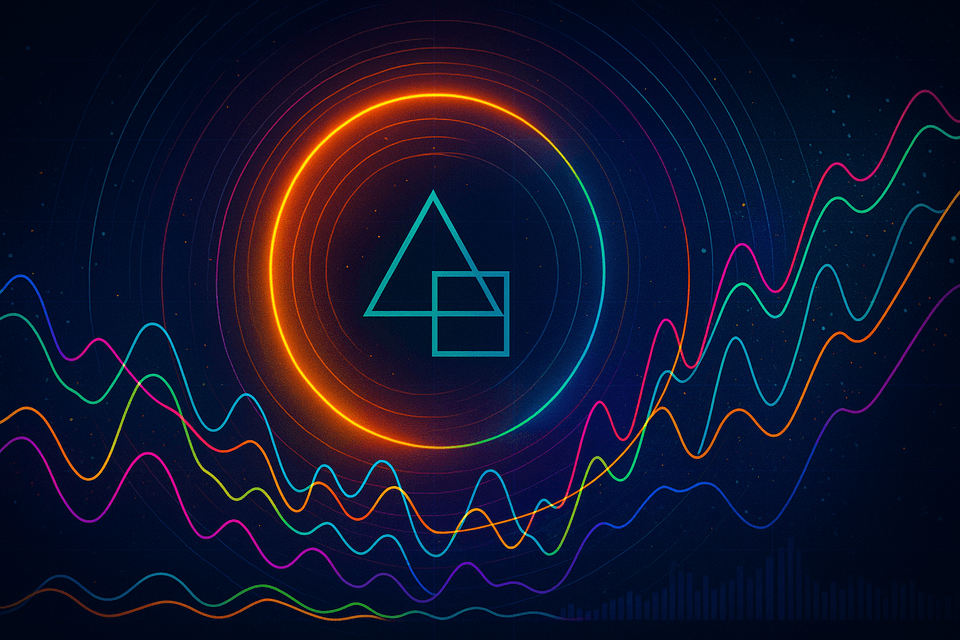

Technical indicators like RSI, Stochastic, and MACD are often treated as oracles. They are better understood as codified crowd behavior. They summarize how we tend to act — our momentum, our mean-reversion impulse — and then hand those summaries back to us as signals we may collectively obey.

RSI (Relative Strength Index) condenses the ratio of average gains to average losses over a lookback (commonly 14). Readings above ~70 are labeled “overbought”; below ~30, “oversold.” If enough traders fade >70 and buy <30, their coordinated action manufactures the pullback or bounce that seems to validate RSI. In thin books, this can happen rapidly; in thick, it can take time and multiple probes.

Stochastic compares the current close to the high–low range over n periods. The %K line (fast) and %D line (smoothed) cross to suggest shifts in momentum. Because ranges are human artifacts (we draw them on screens and cluster stops around them), a stochastic cross near a well-watched range boundary can become a trigger for queued orders — not because the oscillator “knew,” but because we did.

MACD measures the distance between two EMAs (commonly 12 and 26) and compares it to a signal EMA (often 9). Crossovers and zero-line recaptures function as consensus “confirmation.” When a MACD bull cross appears after a base, many systems flip from neutral to long, creating the very follow-through the cross was meant to confirm. On crowded timeframes, MACD can predict itself.

Timeframe matters. The same instrument can be overbought on a 15-minute RSI while neutral on the daily. When most participants watch the same timeframe (e.g., daily closes into an end-of-month rebalance), indicator signals gain causal force. When participants are fragmented, the prophecy weakens, and divergence — between indicator and price, or between horizons — becomes the more informative tell.

Belief as Market Mechanic

Belief has plumbing. It flows through the order book, pools around liquidity pockets, and evaporates when iceberg and hidden liquidity appear where we didn’t expect it. A “resistance” line is just a price level where sellers are believed to live. If price approaches and the book shows offers, many act. If offers vanish or are spoofed, many hesitate. Microstructure enforces or erases the prophecy.

Institutional habits create recurring “prophecy windows.” VWAP reversion and closing-auction targeting invite mean-reverting flows intraday; quarterly index rebalances invite trend reinforcement at the close. Options dealers’ gamma posture can pin price near large strikes when they are long gamma (hedging into moves) or accelerate moves when they are short gamma (hedging with moves). The crowd knows this — and by knowing it, strengthens it.

Stop-losses are prophecy engines. We advertise our invalidation beneath swing lows and above swing highs. Liquidity seekers see the pools; hunting them becomes strategy. A wick through stops “proves” the breakout to those awaiting confirmation while filling the liquidity needs of those who engineered the probe. We call it manipulation; often it is simply the arithmetic of visible belief.

None of this makes indicators useless. It makes them contextual. Signals gain power when they align with known liquidity, dealer positioning, and calendar flows — when the story, the structure, and the plumbing rhyme. They lose power when they fight dominant flows or when too many players crowd the same trade with the same stop.

From Prophecy to Discipline

The mature posture is not to worship signals but to interrogate who will act on them, when, and through what liquidity. Ask three questions: What is the expectation? Where is the liquidity it implies? Who is on the other side when the trigger hits? If you cannot answer, size small or wait.

Treat indicators as mirrors, not maps. Use RSI to estimate where mean-reversion players will appear, not to declare what must happen. Use Stochastic to locate range edges that others sanctify, not to certify reversals. Use MACD to anticipate which systems will chase — and whether their chase has room through the book.

Build confluence from uncorrelated evidence: an RSI extreme plus options gamma polarity plus a calendar catalyst plus visible resting liquidity is not the same as three versions of momentum saying the same thing. Diversity of rationale reduces false prophecy.

Finally, submit belief to risk. Define invalidation where the story breaks, not where you wish it would hold. Size for variance, not for certainty. Track base rates by regime; what worked in low-vol mean-reversion will betray you in high-vol trend. Discipline is how we stop our own expectations from becoming the losses that “prove” we were right too soon.

The Broader Lesson

Economics is reflexive by design. Inflation expectations guide wage negotiations and price-setting; if households and firms expect higher inflation, they may behave in ways that deliver it. Consumer confidence precedes spending; sentiment indices often move before retail sales. Credit conditions loosen when asset prices rise, fueling further rises; they tighten on declines, cementing the downswing.

Policy makers know this and play the expectation game openly. Forward guidance is theatre meant to write the future into the present. If the audience believes, term premia compress, mortgage rates shift, investment brings tomorrow’s capacity into today’s order book. If the audience doubts, guidance loses its magic, and the prophecy stalls.

At the firm level, valuations alter reality. A high multiple cheapens equity financing, invites growth bets, and funds marketing that recruits demand — the story finances itself. A depressed multiple raises the hurdle rate, starves R&D, and can initiate the very stagnation the market “predicted.” Expectations allocate capital; capital shapes outcomes; outcomes justify expectations.

Seen this way, recessions often begin in whispers — CFO surveys pulling back capex, banks inching tighter on standards, households saving a little more. None of these are destiny; all of them are votes. Enough votes and the tally becomes the economy we later measure.

Seeing Through the Veil of Price

The self-fulfilling prophecy is not superstition. It is the choreography of belief. Markets are stages where signals become cues, cues become movement, and movement becomes the story we mistake for fate.

Awareness is the hedge. To notice when an indicator’s power comes not from physics but from participation; to sense when a level holds because enough of us need it to; to recognize when liquidity is an invitation and when it is a trap — this is the craft beneath the charts.

We do not escape reflexivity; we learn to navigate it. Trade what people must do when the bell rings, not what you wish they would do when your model pings. Respect price, but do not be enchanted by it. It is a mirror, not an oracle.

In the end, belief will always reach for confirmation. Let yours reach for context. Look past the script to the stagecraft: who wrote the cue, who will take it, and where the footlights end. Awareness first, action second — and the prophecy loses its spell.