The Dollar as Token, Part II: Quantitative Easing, Tightening, and the Dollar’s Burn Mechanism

In the last piece, “The Dollar as Token: Rethinking Taxes in a Fiat Age,” we shifted the usual story about public finance. Instead of picturing the government as a household that must steadily refill an emptying pot with tax receipts, we treated the dollar as a state-issued token and taxation as something closer to a burn mechanic and a demand anchor. If you must pay your taxes in dollars, you will seek your income in dollars, and that requirement propagates through payrolls, invoices, and points of sale. In that framing, taxes are less about “funding” the issuer and more about shaping the ecosystem in which the issuer’s token circulates. Once you look at the system this way, a new question appears almost immediately: if taxes are one of the ways the state destroys its own tokens and enforces demand for them, what are the other levers that shape how many tokens are sloshing around and how easily they move?

That is where quantitative easing and quantitative tightening enter the picture. They are often invoked in headlines as if they were mysterious macro buttons labelled “stimulus” and “austerity,” but at their core they are balance-sheet operations. They change who holds what kind of dollar claim, on what terms, and with what knock-on effects on credit, asset prices, and ultimately the cost of living. They are not fiscal policy in the narrow sense—that is, they do not decide how much the government spends into the economy or how much it taxes back out—but they sit alongside fiscal decisions as the main tools for managing the liquidity and pricing of the dollar token once it has been issued.

Quantitative Easing: What It Is and How It Works

Quantitative easing is the name given to large-scale asset purchases by the central bank, funded by reserves that the central bank creates for the purpose. In ordinary language, this gets described as “money printing,” but what actually happens is slightly more precise. The central bank announces that it will buy certain financial assets—typically government bonds and sometimes mortgage-backed securities—from commercial banks and other large financial institutions. Those institutions sell the bonds, and in exchange their reserve accounts at the central bank are credited. On the central bank’s balance sheet, assets rise by the amount of securities it now owns, and liabilities rise by the amount of reserves it has created. No taxpayer is debited. No prior pile of gold is drawn down. The issuer simply marks up the numbers in the banking system’s master ledger.

From the perspective of the private sector, quantitative easing changes the composition of portfolios rather than dropping cash into household bank accounts. Banks and other institutions hold fewer longer-term, interest-bearing bonds and more very safe, short-term reserves. Those reserves are the most liquid form of the dollar token available to them, and they can be used to settle payments in the interbank system, support new lending, or be transformed into other assets. At the same time, the central bank’s steady purchases put upward pressure on bond prices and downward pressure on their yields, because it is a large, price-insensitive buyer. Lower yields on government debt translate, through various channels, into lower borrowing costs for mortgages, corporate loans, and other long-term financing.

The intended effect of quantitative easing is to loosen financial conditions when conventional interest rate cuts are no longer enough. By flattening yields, making safe assets less rewarding to hold, and assuring markets that liquidity will be abundant, the central bank is trying to nudge banks and investors into taking more risk: lending to businesses, funding new projects, buying equities, and in general keeping the wheels of credit turning. In theory, this supports employment and output by preventing credit markets from freezing. In practice, it also supports asset prices. When bond yields fall and reserves are plentiful, investors bid up the prices of stocks, real estate, and other assets, and those who already own a lot of assets see their paper wealth swell long before any wage gains filter through the labour market.

It is also worth noting where quantitative easing appears first in the real economy. The first-order effects are felt inside the financial system itself. Primary dealers, major banks, and large asset managers are the ones who actually transact with the central bank, and their balance sheets are the ones most immediately transformed. The broader public feels quantitative easing only as those institutions respond to the new environment: by easing credit in some areas and chasing yield in others, by refinancing certain borrowers and ignoring others, by bidding up property in one city and leaving another untouched. The policy is projected outward through a series of private decisions, not handed directly to households as a cheque.

Quantitative Tightening: What It Is and How It Works

Quantitative tightening is the mirror image of this process. Where easing involves the central bank expanding its balance sheet and buying assets with newly created reserves, tightening involves allowing that balance sheet to shrink and, in some cases, actively selling assets back into the market. When a bond held by the central bank matures, the issuer—usually the Treasury—repays the principal. The central bank can choose not to reinvest those proceeds in new bonds. As it does so, its asset holdings decline. At the same time, the reserve balances that banks held as the corresponding liability on the other side of the central bank’s balance sheet also contract. In more active forms of quantitative tightening, the central bank simply sells bonds back to financial institutions, drains reserves from their accounts as payment, and leaves more of the government’s debt in private hands.

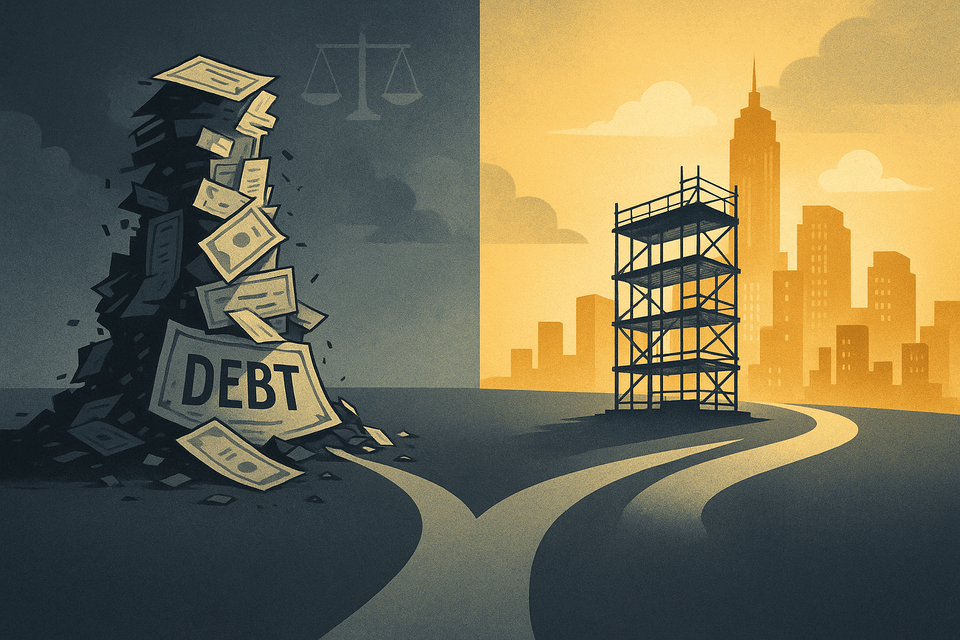

The intended effect here is to tighten financial conditions. As the central bank withdraws from the role of large, price-insensitive buyer, long-term interest rates can drift higher. With fewer reserves in circulation, the interbank system has less ultra-safe liquidity sloshing around, and the implicit subsidy to leverage and risk-taking is reduced. Borrowing becomes more expensive at the margin. Projects that made sense in a world of near-zero yields start to look fragile. Highly indebted firms and households feel a sharper squeeze as refinancing costs increase. The tide that lifted asset valuations under quantitative easing recedes, and in places where the expansion was speculative and extreme, prices can fall significantly and quickly.

Quantitative tightening, like easing, also works through portfolio composition. The private sector ends up holding more longer-term government bonds and fewer reserves. This shift matters because reserves are perfect, risk-free settlement balances for banks, while bonds carry duration risk and can fluctuate in price. A banking system that is flush with reserves can weather shocks more easily; one that holds more bonds must be more careful in how it manages its liquidity. By steadily letting bonds roll off its balance sheet or selling them outright, the central bank is deliberately reducing that cushion and forcing the private financial system to bear more of the term and liquidity risk that had previously been absorbed by the public balance sheet.

QE, QT, and the Liquid Supply of Cash

Both quantitative easing and tightening are often spoken of as if they were giant on/off switches for “the money supply,” but it is important to be specific about what they actually move. The dollar is not a single, uniform object; it exists as different kinds of claims in different parts of the system. There are reserves held by banks at the central bank, deposits credited to households and firms at commercial banks, government bonds and bills with various maturities, and a long tail of private IOUs. Quantitative easing increases the volume of reserves and decreases the amount of long-term government debt held by the private sector. Quantitative tightening does the opposite. Neither directly creates or destroys the dollar balances in your personal current account on the day the operation is announced. Instead, they rearrange the plumbing through which banks extend credit and settle payments, and they influence the interest rates at which new credit is made available.

When these balance-sheet operations are combined with fiscal policy—government decisions about how much to spend and tax—the picture becomes clearer. If the Treasury runs a deficit, it spends more tokens into the private sector than it taxes back, and it issues bonds to the private sector as a record of that deficit. If, at the same time, the central bank is conducting quantitative easing, it may buy some of those bonds back from the private sector and replace them with reserves. From the perspective of the consolidated state, the net effect is that more dollar tokens have been created and left in private hands, and some of them sit as deposits and reserves rather than as bond holdings. If quantitative tightening takes place alongside higher taxes or lower spending, the state is both draining deposits and reserves from the private sector through fiscal flows and reshuffling remaining claims into longer-term, interest-bearing instruments with less immediate liquidity. These combinations matter because they decide not only how many net tokens the private sector holds, but also in what form and under what terms they can be deployed.

The real-world deployment of these policies is not an abstract exercise. Central banks and treasuries pull these levers in response to crises, booms, and political pressures. After a financial crisis, for example, the central bank may drive interest rates towards zero and initiate large-scale asset purchases to prevent a cascade of defaults, while the fiscal authority may increase spending or cut taxes to cushion households and firms. The result is a surge of new net financial assets into the private sector and an environment in which borrowing is unusually cheap. As the economy stabilises and inflation pressures build, the same institutions may reverse course: raising interest rates, slowing or reversing asset purchases, and tightening fiscal policy. The apparent technicality of “allowing the balance sheet to run off” translates in practice into higher mortgage rates, more expensive corporate refinancing, and a shift in sentiment from exuberance to caution.

In that sense, quantitative easing and tightening are not independent of the story about the liquid supply of cash; they are one of the main ways in which the state shapes the distribution and liquidity of its own token claims once they have been created. Deficits and surpluses decide how many net tokens the private sector ends up with. QE and QT decide how many of those tokens sit as immediately usable bank reserves, how many are locked up in longer-term bonds, and what price the market demands to transform one form into another through borrowing and lending.

Everyday Life, Cost of Living, and Taxation as Token Burn

For the average citizen, all of this central bank plumbing shows up in very immediate ways. When quantitative easing pushes down long-term interest rates, mortgage rates tend to fall, and those with access to credit can lock in cheaper financing for homes. This increased purchasing power can drive up house prices, especially in markets where supply is constrained. Landlords see higher valuations and may raise rents accordingly. Young families trying to buy their first home find that the entry ticket has moved further out of reach, even though their wages have not grown at the same pace. Asset owners feel wealthier on paper, while non-owners see the walls of the asset world rise around them. When the cycle turns and quantitative tightening takes hold, borrowing costs move higher. Adjustable-rate mortgages reset at painful levels, credit card interest rates climb, and highly leveraged households feel each decimal point of rate increases as a direct strain on their monthly budget.

Employment and wages are similarly filtered through this machinery. In a world of aggressive easing and cheap credit, firms can borrow more easily to expand operations, roll over existing debts, and experiment with new ventures. That environment is more forgiving of mistakes and slow returns, and in aggregate it tends to support higher levels of employment. When conditions tighten, marginal projects are cancelled, hiring plans are cut back, and wage growth slows or reverses. A small business whose bank is suddenly more cautious about extending credit may freeze hiring or let staff go. A corporation staring at higher refinancing costs may focus on debt reduction rather than pay rises. A worker may never hear the words “quantitative tightening” at their performance review, but the macro choice to drain reserves and raise rates is present in the background logic that shapes how generous their employer can afford to be.

Savings and pensions are also entangled in this dance. Quantitative easing tends to push up the value of bonds and equities, which improves the funding status of pension funds and lifts the balances of those with investment portfolios. But again, the distribution of who owns those assets is heavily skewed. When asset prices are repeatedly rescued and inflated while wage growth remains modest, the gap between those who own and those who rent, between those who have portfolios and those who live paycheque to paycheque, widens. Quantitative tightening can puncture some of these valuations, but it often does so in a way that punishes latecomers and the highly leveraged as much as, or more than, the entrenched and diversified.

All of this loops back to the earlier claim that taxation in a fiat system looks more like a token burn mechanism than a funding necessity. In a world where the state can, through institutional machinery, create reserves with keystrokes and remove them just as cleanly, it is misleading to imagine that there is a single pool of pre-existing money that must be collected from taxpayers before anything can be spent. Central bank operations like quantitative easing and tightening demonstrate that new high-powered money can be created to support asset markets and maintain liquidity when it is deemed systemically necessary. Fiscal operations show that new deposits can be created in the private sector simply by crediting accounts when the state spends. Taxes, in this architecture, are the mechanism by which some of those tokens are later extinguished and by which ongoing demand for the token is enforced.

Seen together, the trio of tools—fiscal expansion and contraction, quantitative easing and tightening, and the setting of interest rates—compose the choreography of the dollar token’s life cycle. Tokens are born into private balance sheets when the state spends or when the central bank expands its balance sheet. They change shape and liquidity as bonds are swapped for reserves and reserves are drained back into longer-term claims. They die when taxes and other obligations to the state are paid. The technical language of “large-scale asset purchases,” “reserve balances,” and “balance sheet run-off” can obscure the simple underlying pattern: the issuer has multiple ways to change how many tokens exist, in whose hands they sit, and how easy they are to mobilise. For the person navigating rent, groceries, wages, and debts, these choices are felt as shifts in what is affordable, how secure their job feels, and how plausible it is to build any kind of financial cushion.

If we insist on seeing taxes only as the government “getting its money back” in order to spend again, we miss the role they play within this larger machinery. The state can and does create its own tokens to support systems and sectors it deems vital. It does not wait for taxpayers to refill a vault in order to do so. Taxation, then, is better understood as the deliberate destruction of some fraction of the tokens it has already issued and as the legal and psychological anchor that makes its token the one everyone wants and needs to hold. Quantitative easing and tightening show us how flexibly the issuer can move tokens into and out of the financial system. Taxes remind us that, in the end, the issuer also has the power to call them home and remove them from circulation entirely.