The Logistics of Civilisation

A meditation on how water, trade routes, and the physics of movement shaped where cities formed—and how the human body itself quietly authored the logic of streets, corridors, and built space.

Liquidity, incentives, cycles and risk — how value is created, transferred and sometimes destroyed.

Page 1 of 4

RSS feed

A meditation on how water, trade routes, and the physics of movement shaped where cities formed—and how the human body itself quietly authored the logic of streets, corridors, and built space.

Modern businesses don’t just sell products—they build systems. From cross-subsidy and loss leaders to subscriptions like Prime, profitability is increasingly engineered across an ecosystem, over time, by shaping habit and default choice.

An introduction to GigFin, a free and open source income tracking app built for gig workers navigating multiple platforms and seeking clearer insight into their earnings.

Exploring how quantitative easing and tightening reshape the dollar’s balance-sheet architecture, and how taxation functions as a burn mechanism within a fiat token system.

In a post–gold standard world, the US dollar behaves less like a claim on scarce metal and more like a state-issued token—making taxes less about “funding” government and more about burning tokens to manage inflation and anchor demand for the currency.

A meditation on the cyclical rhythm of history—how moments like 1918, 1920, and 1929 reveal repeating human patterns of crisis, forgetting, and consequence, and what it would mean to truly learn from them.

Time changes value, and every choice carries a “compared to what?”—a lens that links the time value of money, opportunity cost, and discount rates to real decisions in life and business.

A practical lens (T5) for seeing the transactional rails beneath modern life—Asset, Price, Ledger, Protocol, Power—and for designing humane counters: thick consent, commons-first systems, and dignity-preserving friction where it matters.

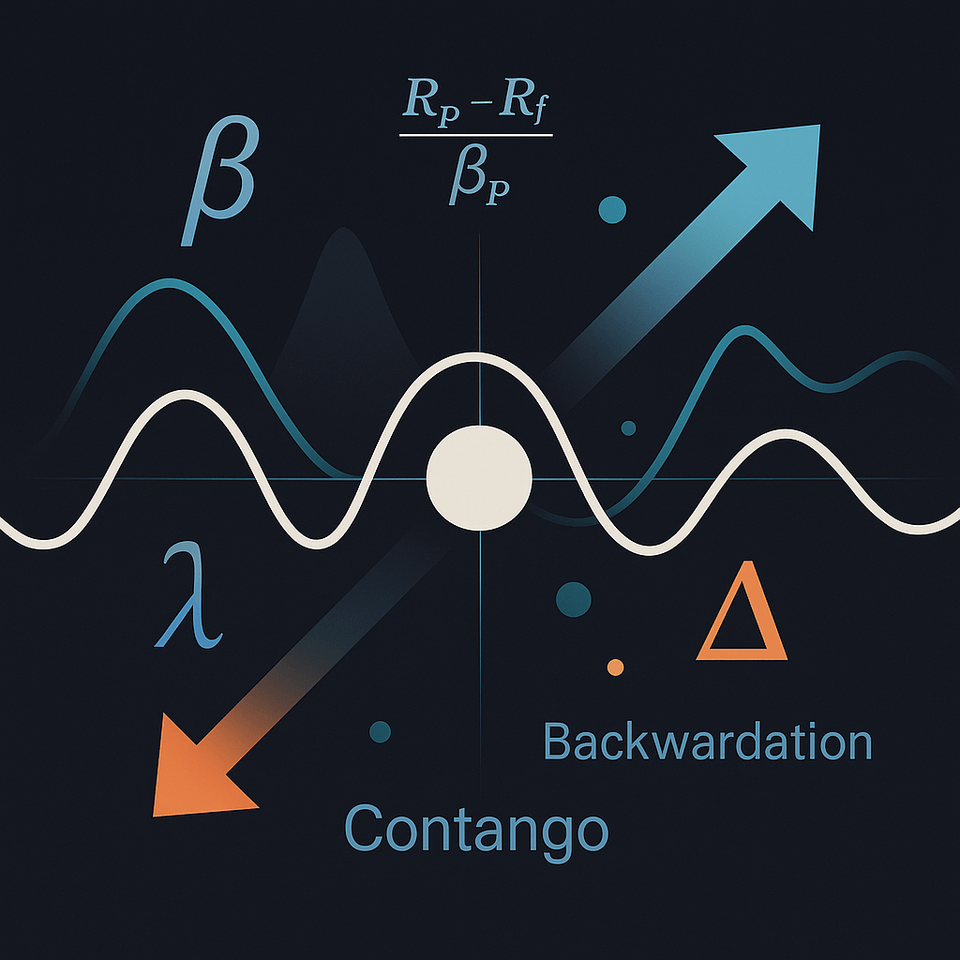

Markets speak their own language — full of ratios, Greeks, and curious words like backwardation or contango. This guide breaks down some of the most common (and misunderstood) terms used in trading and investment circles.

Markets, like minds, move not only on facts but on expectations. The self-fulfilling prophecy shows how shared beliefs turn into order flow, liquidity events, and ultimately the prices that seem to “confirm” those beliefs.