The Hidden Hand of the Market: Understanding Market Makers and Inventory Risk

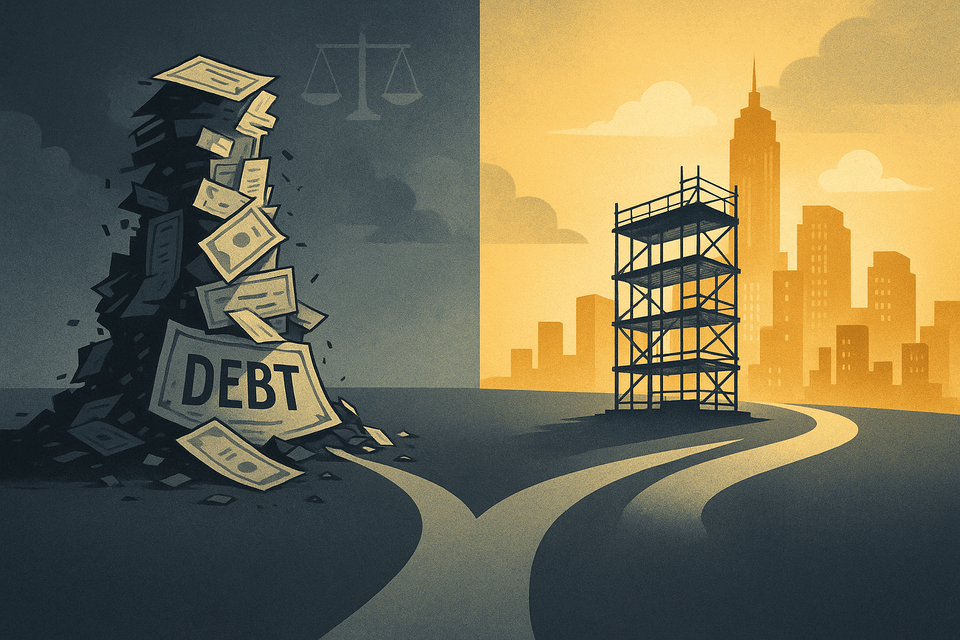

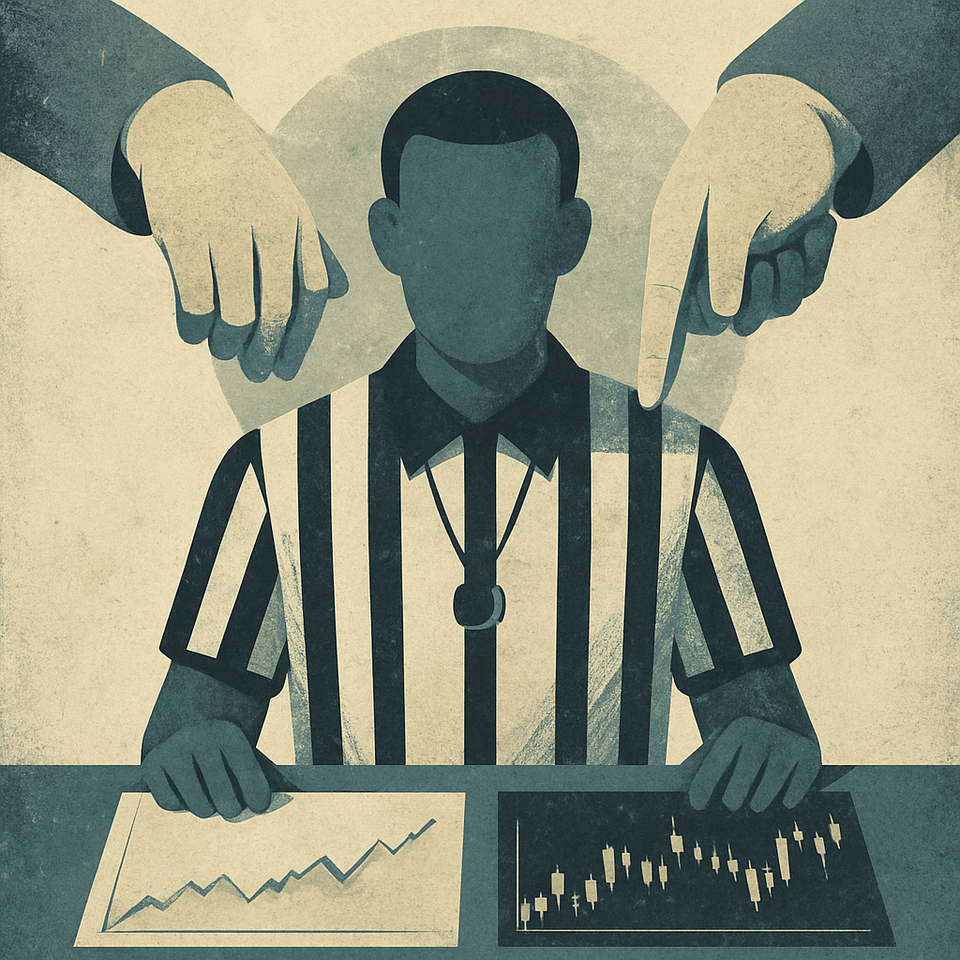

Market makers are often described as neutral referees — silent guardians of liquidity. But neutrality is an illusion. This essay explores spreads, inventory balancing, OTC desks, adverse selection, and hedging to show how dealers shape price through vested interest. To see the hidden hand is the first step in no longer being led by it.