Considering the Shift of the Overton Window

The Overton Window isn’t a fixed pane but a living frame that shapes what a society can see, say, and imagine. Tracing its shifts reveals our collective identity—and our responsibility within it.

Page 6 of 12 | Posts 51-60 of 119 posts

From first principles to practice.

The Overton Window isn’t a fixed pane but a living frame that shapes what a society can see, say, and imagine. Tracing its shifts reveals our collective identity—and our responsibility within it.

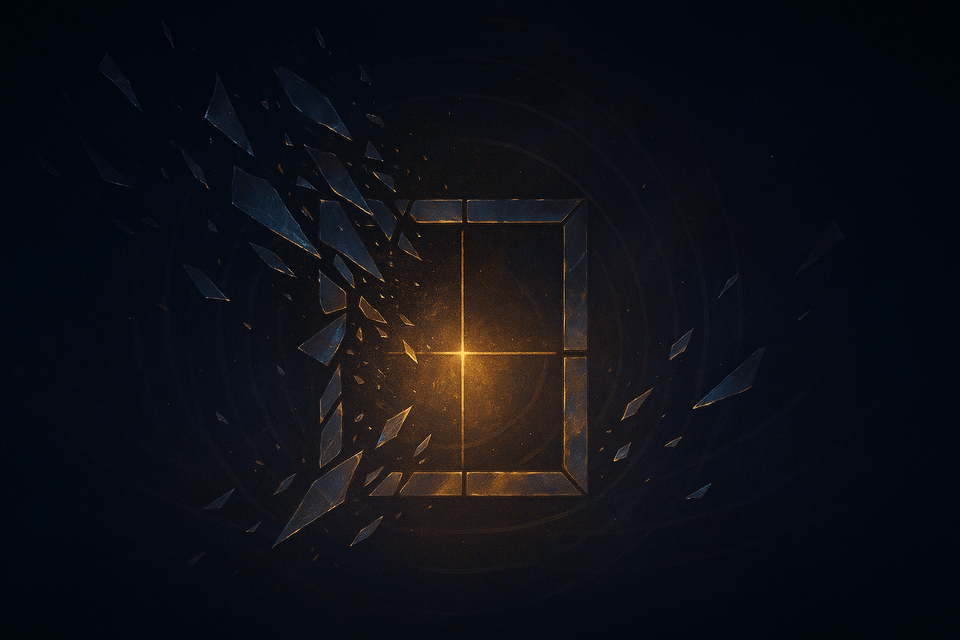

We build our worlds on belief—often reinforced by the echo of others—until illusion collapses and demands the harder work of integrity, repair, and renewal. This essay traces the arc from chorus to shattering to redemption.

A European robin “sees” Earth’s magnetic field through quantum effects in its eye—an elegant bridge between physics and life. This essay follows how cryptochrome, radical pairs, and entanglement helped launch quantum biology and reframes what it means to navigate.

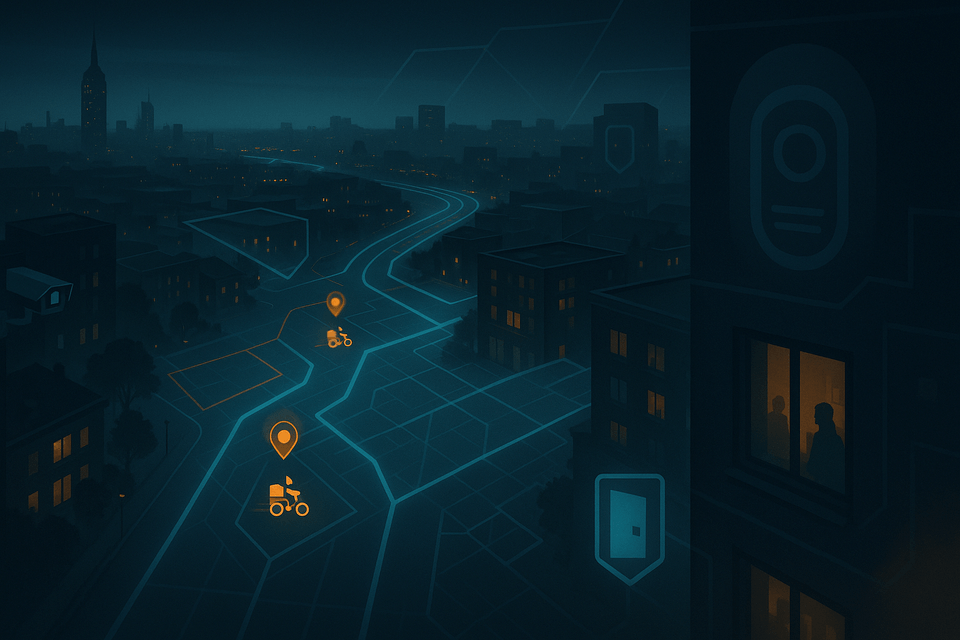

From Google Maps rerouting entire towns to Amazon Flex unlocking apartment doors, corporations are reshaping our infrastructure and routines—quietly trading our privacy for convenience.

Six days off, a fresh Astro build, and a clean slate for writing: better theming and layout control, first-class LaTeX, and the freedom to ship my own features—because I thought I could code this better myself, and I did.

Sleep isn’t passive—it’s nightly maintenance. Slow-wave and REM rebuild muscle and connective tissue, balance hormones, and flush daytime metabolic waste via the glymphatic system to restore neurotransmission. The payoff: sharper cognition, steadier mood, healthier metabolism, heart, and immunity.

NuScale’s small modular reactors promise more than clean, modular power on the ground—they hint at a future of airborne carriers the size of stadiums, loitering in the skies for months at a time. This post explores how SMR technology could unshackle endurance, transforming not only energy but the architecture of power itself.

“Letting go” has become the modern mantra. Yet if we relinquish all we desire, what remains to root a life? This piece argues for open-handed love—attachment, protection, loyalty—and the chosen weight of responsibility: showing up for one another, guiding and growing together. Is this not what life is about?

Kindness is not weakness or naïveté. It is strength forged through suffering, the power to harm restrained, the beauty of choice made again and again. Unlike niceness, which avoids conflict, kindness endures it—and transforms it.

Investing and trading aren’t opposites so much as different relationships to time. This guide clarifies frames—from scalping to position trading—and argues that most edge is born in ranges, not headlines. Choose your horizon, respect its rules, and let discipline—not drift—set your course.