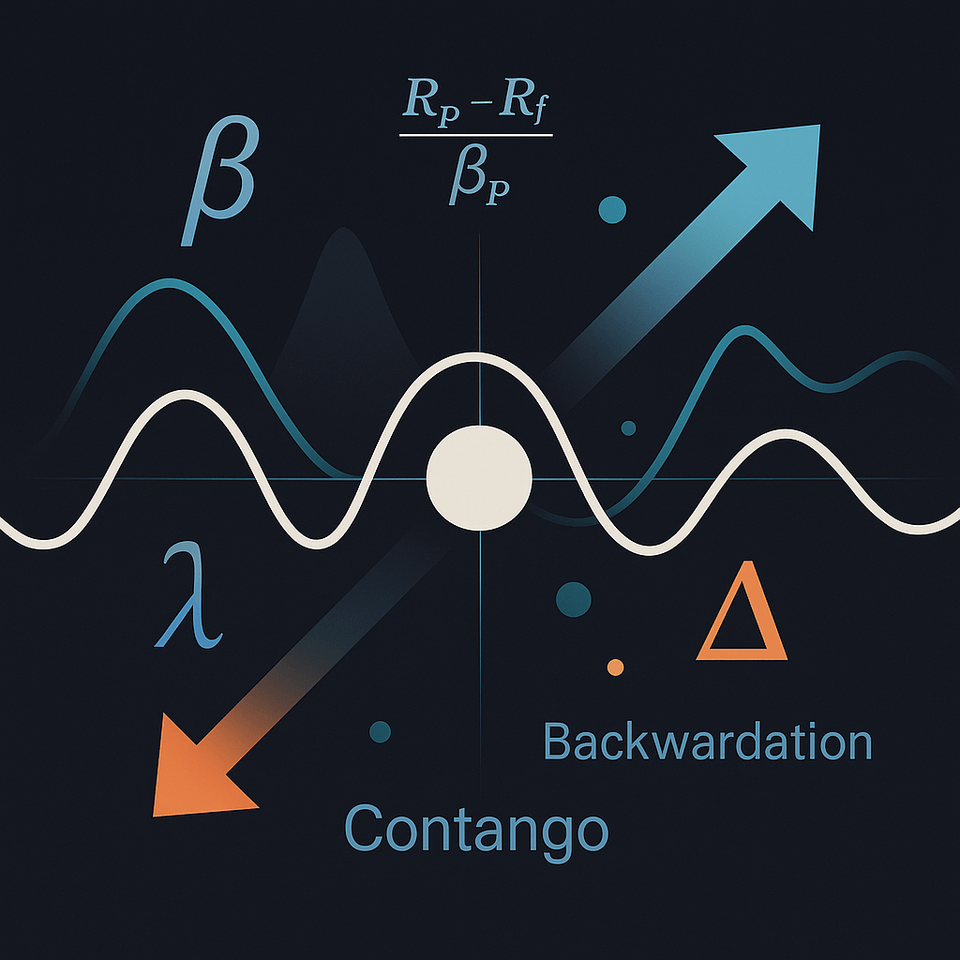

Decoding Market Jargon: Common Terms Every Investor Should Understand

Markets speak their own language — full of ratios, Greeks, and curious words like backwardation or contango. This guide breaks down some of the most common (and misunderstood) terms used in trading and investment circles.