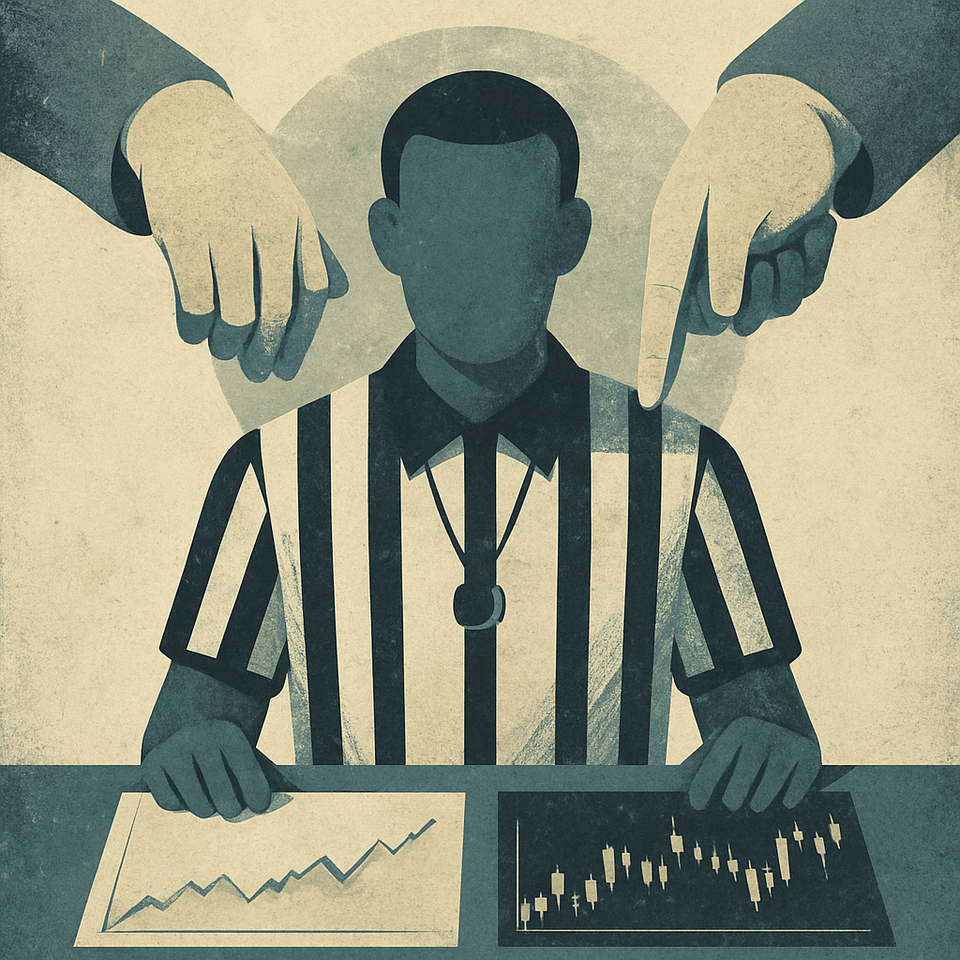

Investing vs. Trading: Two Paths Through the Market

Investing and trading aren’t opposites so much as different relationships to time. This guide clarifies frames—from scalping to position trading—and argues that most edge is born in ranges, not headlines. Choose your horizon, respect its rules, and let discipline—not drift—set your course.