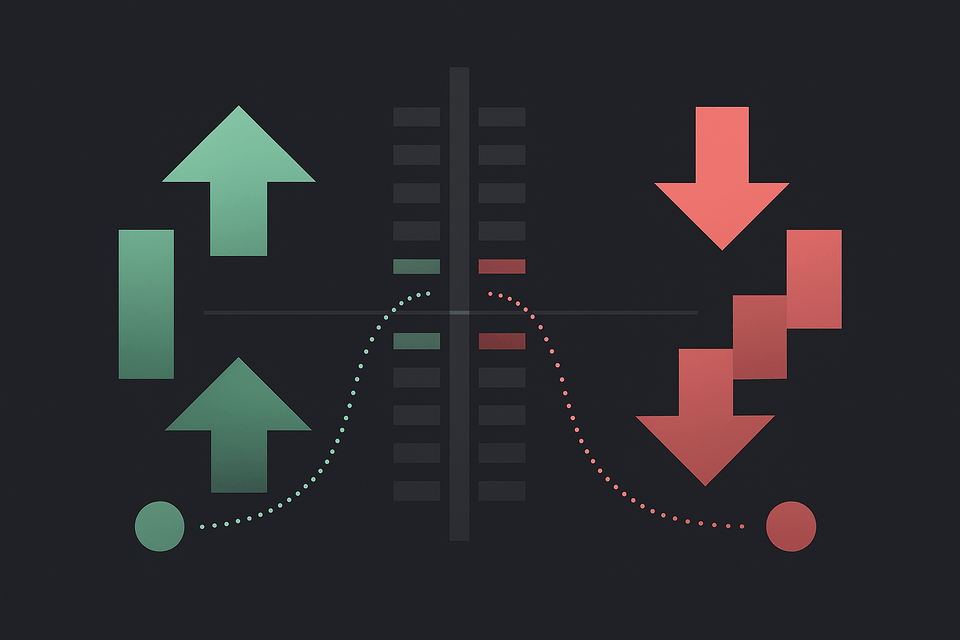

Daily vs Weekly Market Closes: Mechanics, Gaps, and Why They Matter

The “close” is a mechanism, not just a timestamp. This essay explains how daily and weekly closes differ in auction/settlement, liquidity, and halt structure—why that creates gaps, and how those gaps behave across futures, FX, and crypto.